Business Insurance in and around Beaverton

One of the top small business insurance companies in Beaverton, and beyond.

No funny business here

Coverage With State Farm Can Help Your Small Business.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all by yourself. State Farm agent Lateef Kirsten, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

One of the top small business insurance companies in Beaverton, and beyond.

No funny business here

Small Business Insurance You Can Count On

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a dentist or a fence contractor or you own a meat or seafood market or a dental lab. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Lateef Kirsten. Lateef Kirsten is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

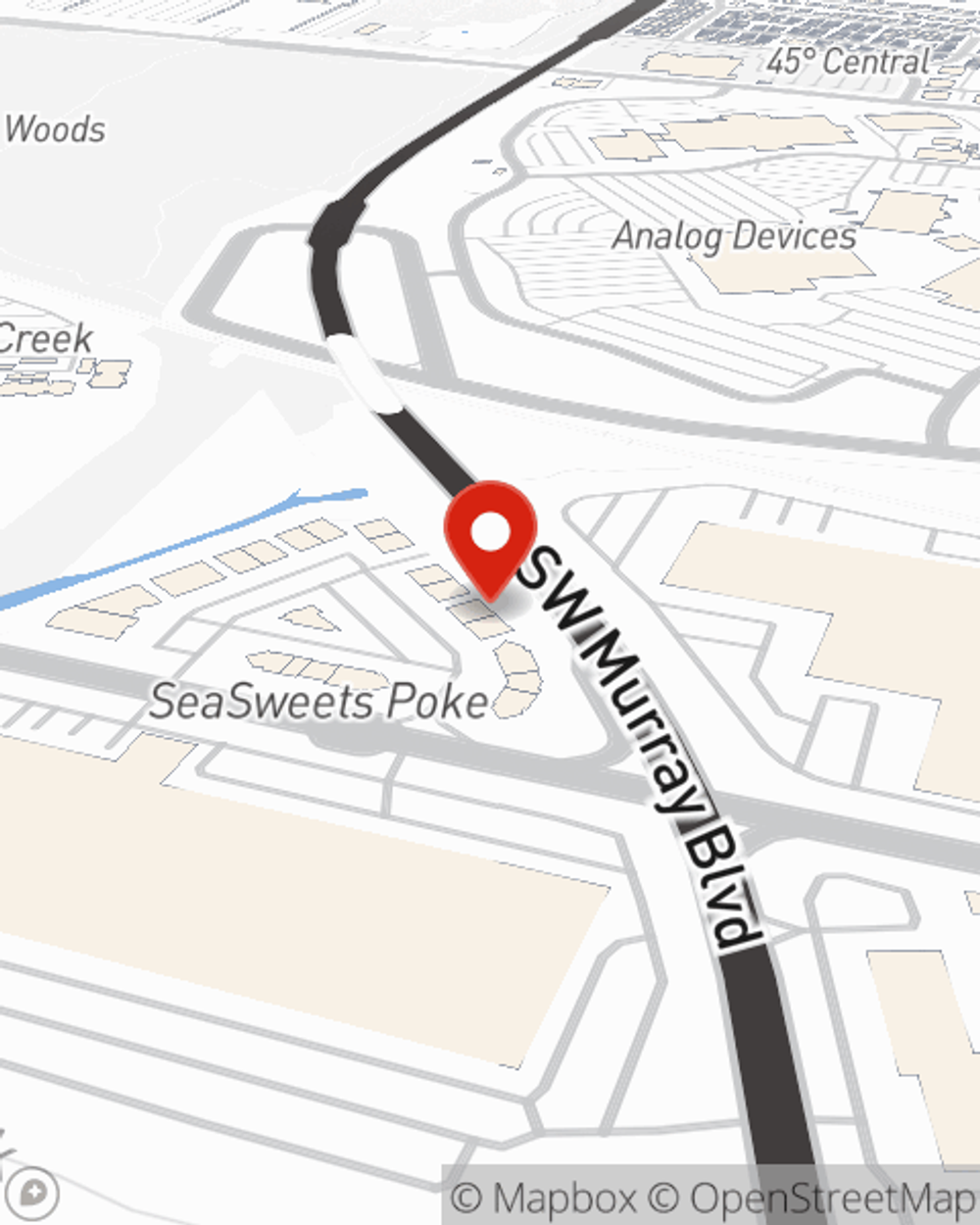

At State Farm agent Lateef Kirsten's office, it's our business to help insure yours. Visit our wonderful team to get started today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Lateef Kirsten

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.